When deciding on a small business lender which can loans the loan in 24 hours or less, you need the one that helps to make the procedure easy. Versus an easy online software and white documentation criteria, will it be most short resource? Quick Money lets you sign up for that loan employing on line application otherwise cellular application and you can, in many cases, will bring you the cash you need you to exact same day. It is hence and one to Rapid Fund try all of our choice once the better choice financial having timely money.

The fresh Verdict

Rapid Money brings small enterprises with fast funding on aggressive pricing. That have versatile conditions, an easy online software, and you will casual official certification, it’s our very own possibilities since most useful option financial to possess prompt capital.

Fast Loans

The better the score, the lower interest possible shell out. Option lenders usually charge even more during the focus than their banking alternatives, however they are in addition to happy to financing to borrowers financial institutions might not consider.

Currently, brand new Annual percentage rate to the a business mortgage out-of an option bank ranges out-of dos.5% toward large double digits. Dependent on your credit rating, a loan out-of an option bank might not be worthwhile. Although not, Fast Funds does not fees one origination or documents costs. You pay desire for the its home business financing, however of the mortgage facts may charge fees outside of the desire. Be sure to inquire about that before continuing with this particular financial.

Tip: Even although you get approved for a loan, keep in mind the conditions. Your credit rating usually influence their price of borrowing. Both same-go out money actually worth every penny in case your interest rate is too large.

Making an application for that loan

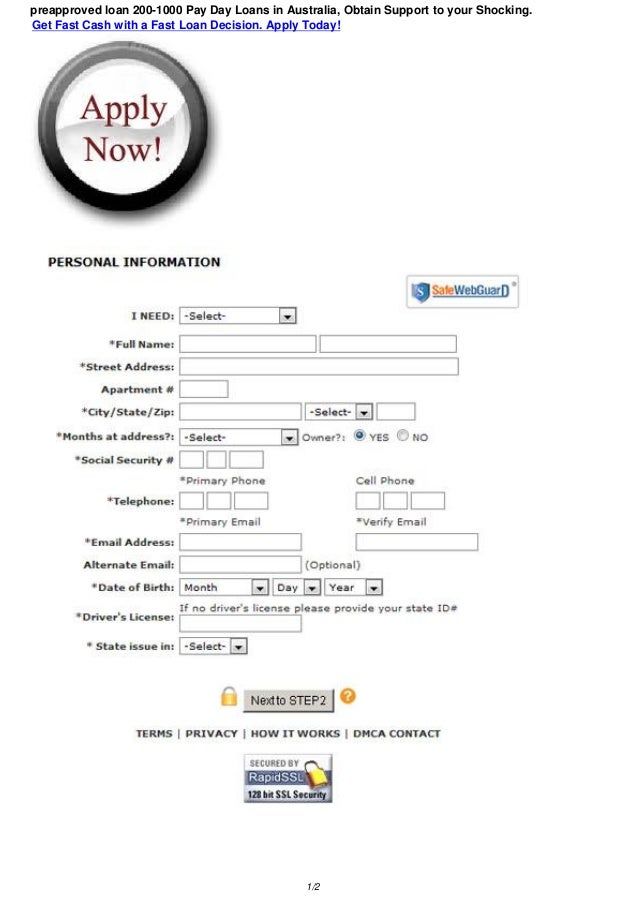

Applying for a loan which have Fast Financing starts with completing an effective easy on the internet app. Quick Funds requires your several inquiries, particularly regarding your ages operating, annual sales, fee which comes away from playing cards, and you will credit rating. It will upcoming let you know the most you could potentially prequalify to possess. You decide on the amount and offer more information (as well as your Public Protection count), and you may Rapid Fund will procedure the loan. By using the Fast Money cellular app, on-the-go entrepreneurs can easily get that loan without being at the job. That isn’t real of all of the lenders we reviewed. For example, Crest Funding, that also provides exact same-go out funding, does not have any a cellular software option.

It lender will work with individuals having incomplete borrowing and you will doesn’t require far files. You would like a corporate family savings, three months out of team financial comments, and you will a form of ID because of its seller payday loans. For the quick-name loans, you should have been in business for a couple of in order to five decades.

Fast Loans features an online product that can help choose an educated financing choices for you considering your credit rating.

Financing Items and you can Words

Fast Finance has the benefit of small business money within the quantity of $5,one hundred thousand to help you $ten billion. You might pay their finance with regards to around three to 60 months.

Which financial also offers a multitude of alternative financial support choices, as well as label finance, lines of credit, link finance, SBA loans, charge factoring, merchant cash advances, asset-founded funds, commercial real estate loans and healthcare cash advances. You can make use of the fresh loans for company mission, plus inventory and payroll.

Featuring its small business funds, you are charged a predetermined interest and you will needed to make day-after-day, per week, otherwise monthly obligations. The bucks are automatically subtracted out of your savings account. One assurances you don’t miss a cost, that could adversely feeling your credit rating. You can obtain $5,000 so you can $1 million that have fees times off three to help you 60 months. [Related Content: How to pick a business Loan]